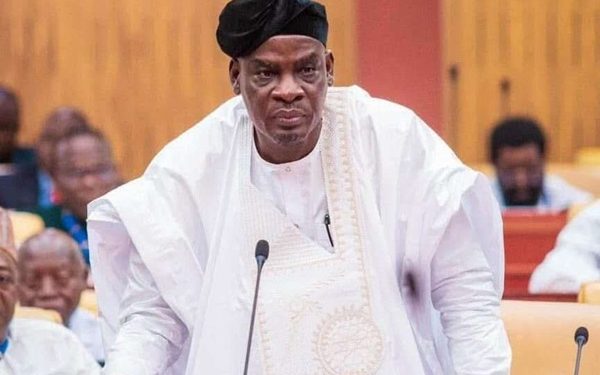

The Governor of the Bank of Ghana (BoG), Dr. Johnson Asiama, has issued a firm reminder that the U.S. dollar is not legal tender in Ghana and should not be accepted as payment for goods and services within the country.

Speaking at the ABSA-UPSA Quarterly Banking Roundtable on Thursday,July 17,Dr. Asiama emphasized that businesses and individuals are under no obligation to accept U.S. dollars, urging Ghanaians to insist on the exclusive use of the cedi in commercial transactions.

“The dollar is not legal tender. It cannot go everywhere the cedi goes,” he said. “If you pay me in dollars for a service or product, I have every right to say no.”

The governor's remarks come amid growing concerns over the informal use of foreign currencies, particularly in high-value transactions and real estate, which economists warn could undermine confidence in the local currency.

Dr. Asiama called on the public to actively support the stability of the cedi, noting that adherence to its exclusive legal tender status is not only a regulatory requirement but a matter of national economic interest.

“Any attempt to displace the cedi in ordinary transactions—whether through dollar invoicing, preferential foreign pricing, or informal substitution—is economically distorting and legally impermissible,” he warned.

He cautioned that speculative behavior tied to currency volatility could further erode monetary sovereignty and weaken Ghana’s macroeconomic policy tools.

“The legal tender status of the cedi is not ceremonial—it is the cornerstone of macroeconomic governance. It anchors monetary policy, interest rates, and liquidity management,” Dr. Asiama added.

The BoG has in recent months taken steps to curb the dollarization of the economy, including tighter foreign exchange regulations and public education campaigns aimed at reinforcing the role of the cedi.